Spring is in full force; the summer months are right around the corner. If you are debating moving up to your dream home, here are four great reasons to consider buying today instead of waiting.

1.) Buyer Demand is High & Inventory Is Low

Recent numbers show that buyer demand is at the highest peak experienced in years, and inventory for sale is at a 4.6 months supply, which is still markedly lower than the 6.0 months needed for a historically normal market.

The National Association of Realtors, Chief Economist, Lawrence Yun put it this way,"Demand in many markets is far exceeding supply, and properties in March sold at a faster rate than any month since last summer."

Listing your home today can greatly increase exposure to buyers who are out in force and ready to act.

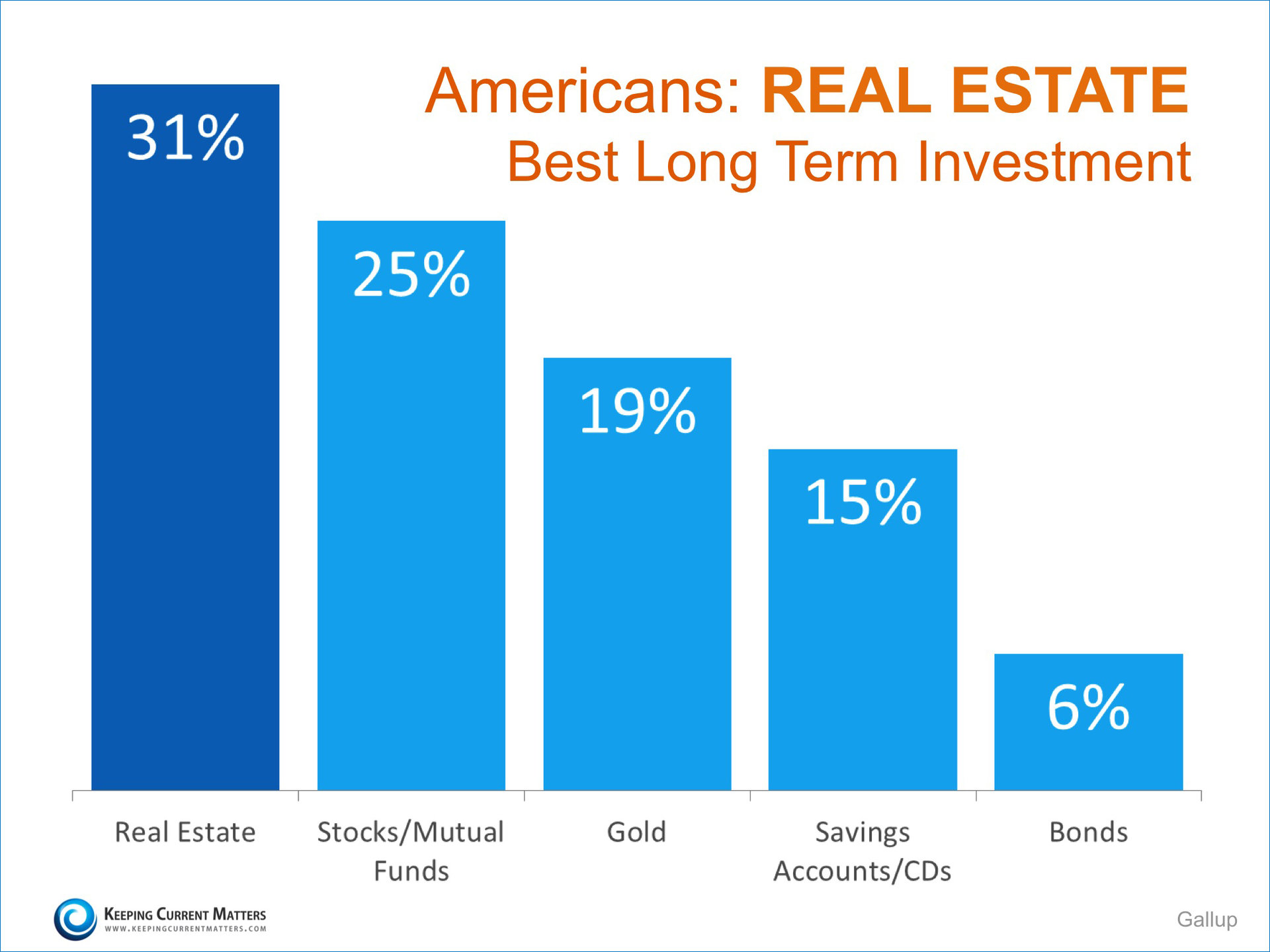

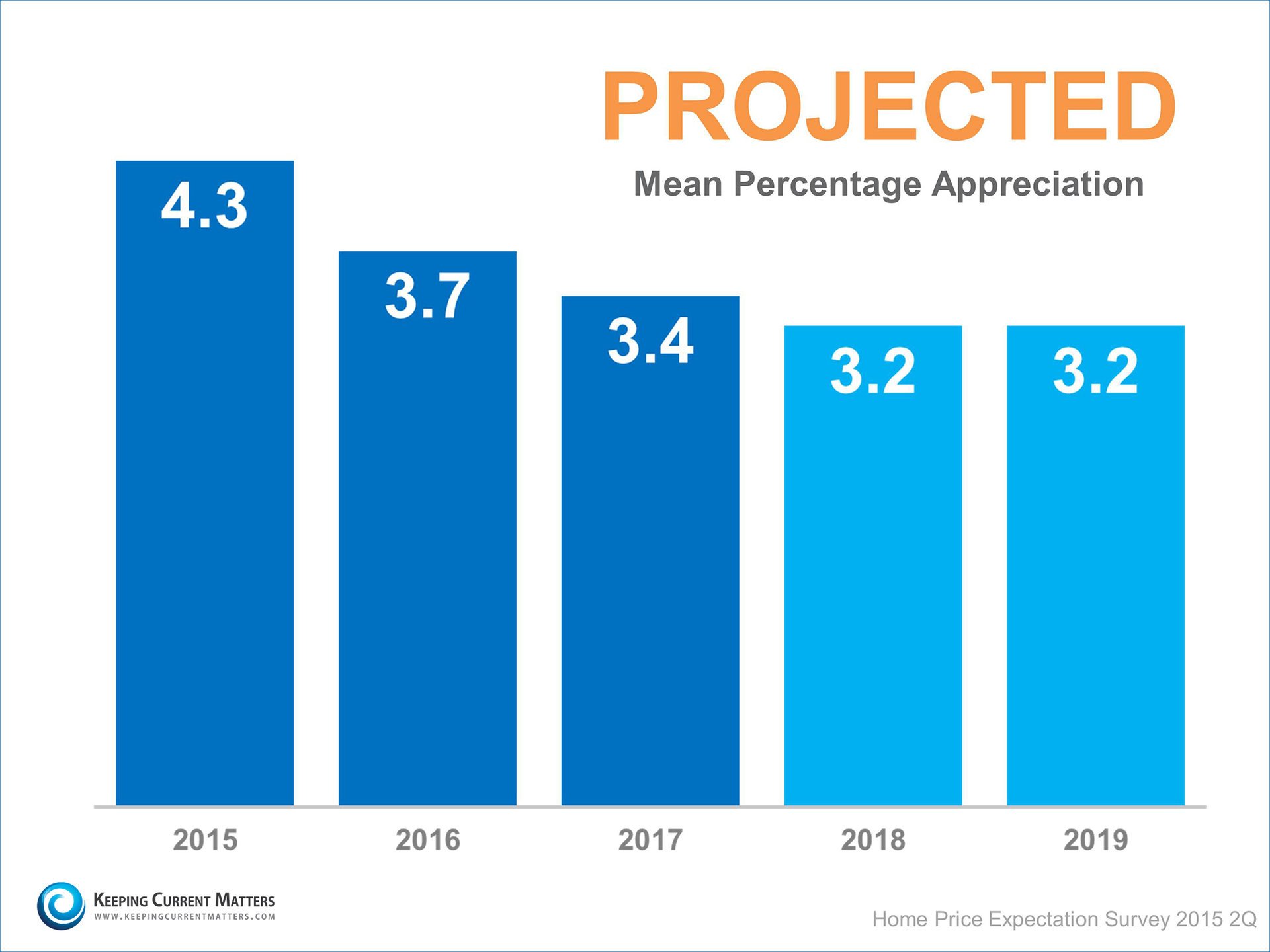

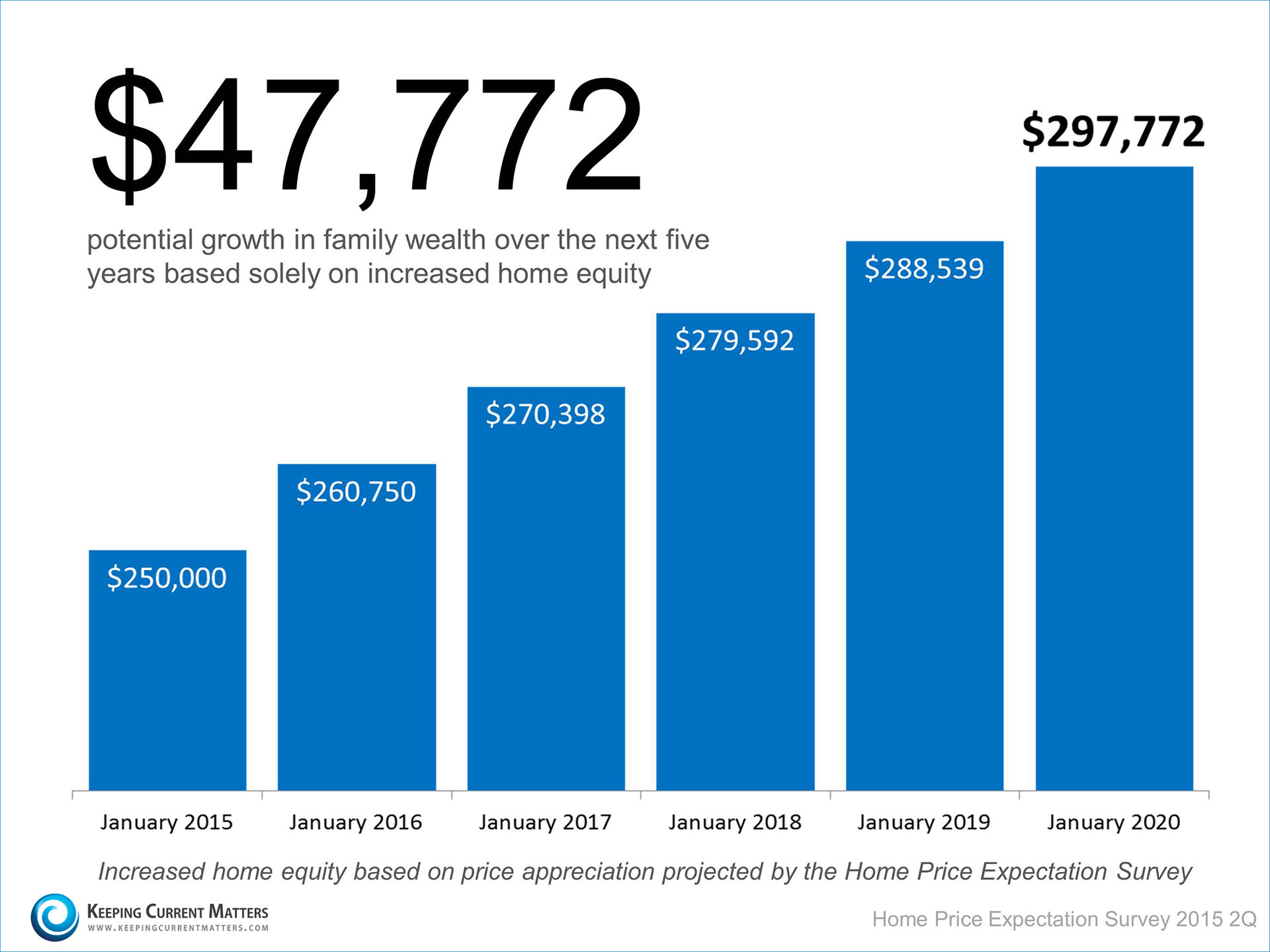

2.) Prices Will Continue to Rise

The Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report projects appreciation in home values over the next five years to be between 11.7% (most pessimistic) and 27.5% (most optimistic).

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting for your current home’s value to increase before selling could price you out of your new home if you aren’t careful.

3.) Mortgage Interest Rates Are Still Near Record Lows

As we reported last week, interest rates have remained below 4% for some time now, and are substantially lower than the rate previous generations paid when getting a mortgage.

The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison projecting that rates will rise over the next 12 months.

An increase in rates will impact YOUR monthly mortgage payment. Even an increase of half a percentage point can put a dent in your family’s net worth. Whether you are moving up or buying your first home, your housing expense will be more a year from now if a mortgage is necessary to purchase your home.

4.) It’s Time to Move On with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise. But, what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide whether it is worth waiting. Have you always wanted to live in a certain neighborhood? Would a climate change be just what the doctor ordered? Would you like to be closer to family?

Bottom Line

If the right thing for you and your family is to move up to your dream home this year, buying sooner rather than later could lead to substantial savings.

![Do You Know The Cost of Renting vs. Buying? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/05/Rent-vs.-Buy-KCM.jpg)