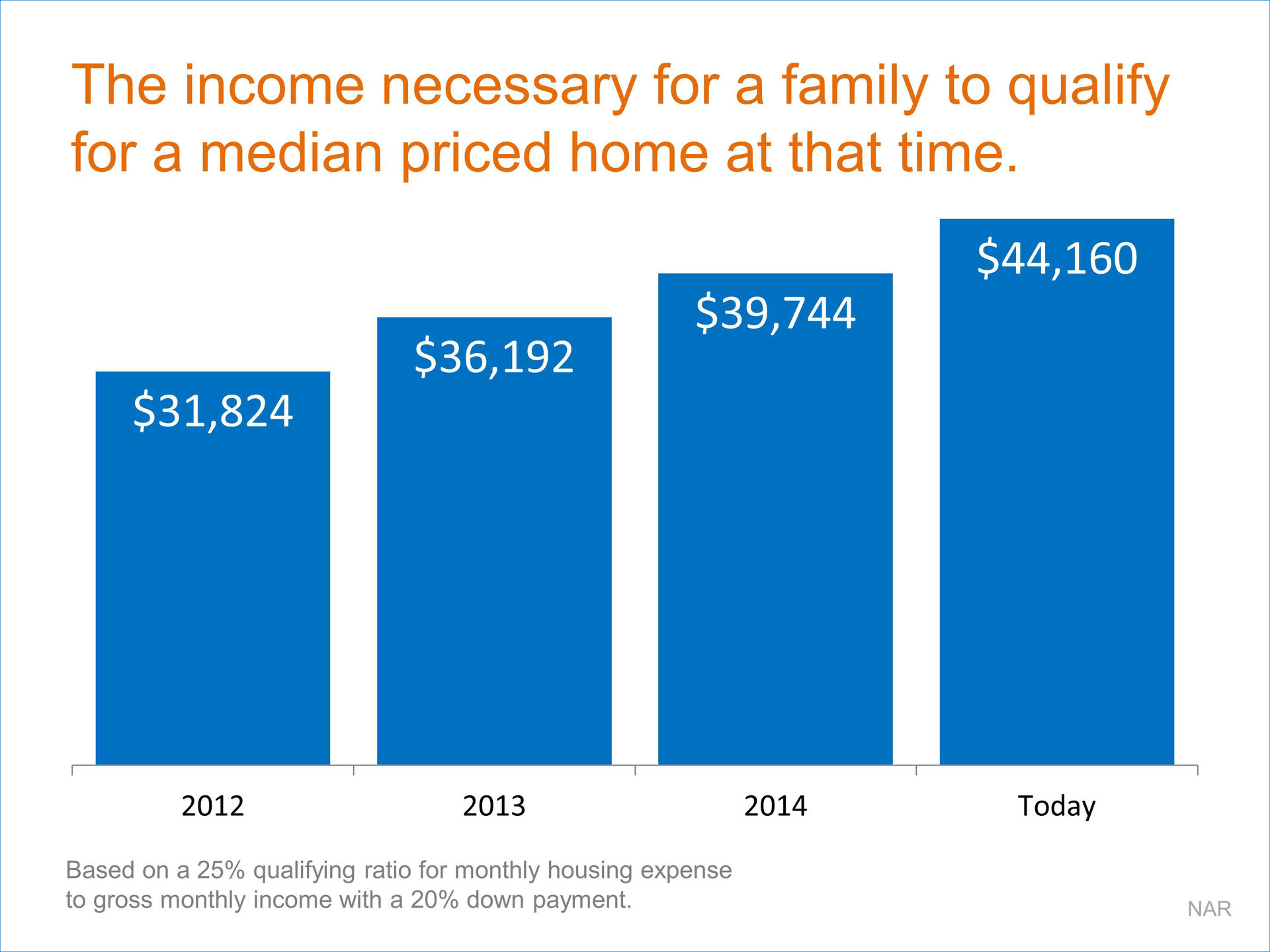

The National Association of Realtors (NAR) recently released their July edition of theHousing Affordability Index. The index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.

NAR looks at the monthly mortgage payment (principal & interest) which is determined by the median sales price and mortgage interest rate at the time. With that information, NAR calculates the income necessary for a family to qualify for that mortgage amount (based on a 25% qualifying ratio for monthly housing expense to gross monthly income and a 20% down payment).

Here is a graph of the income needed to buy a median priced home in the country over the last several years:

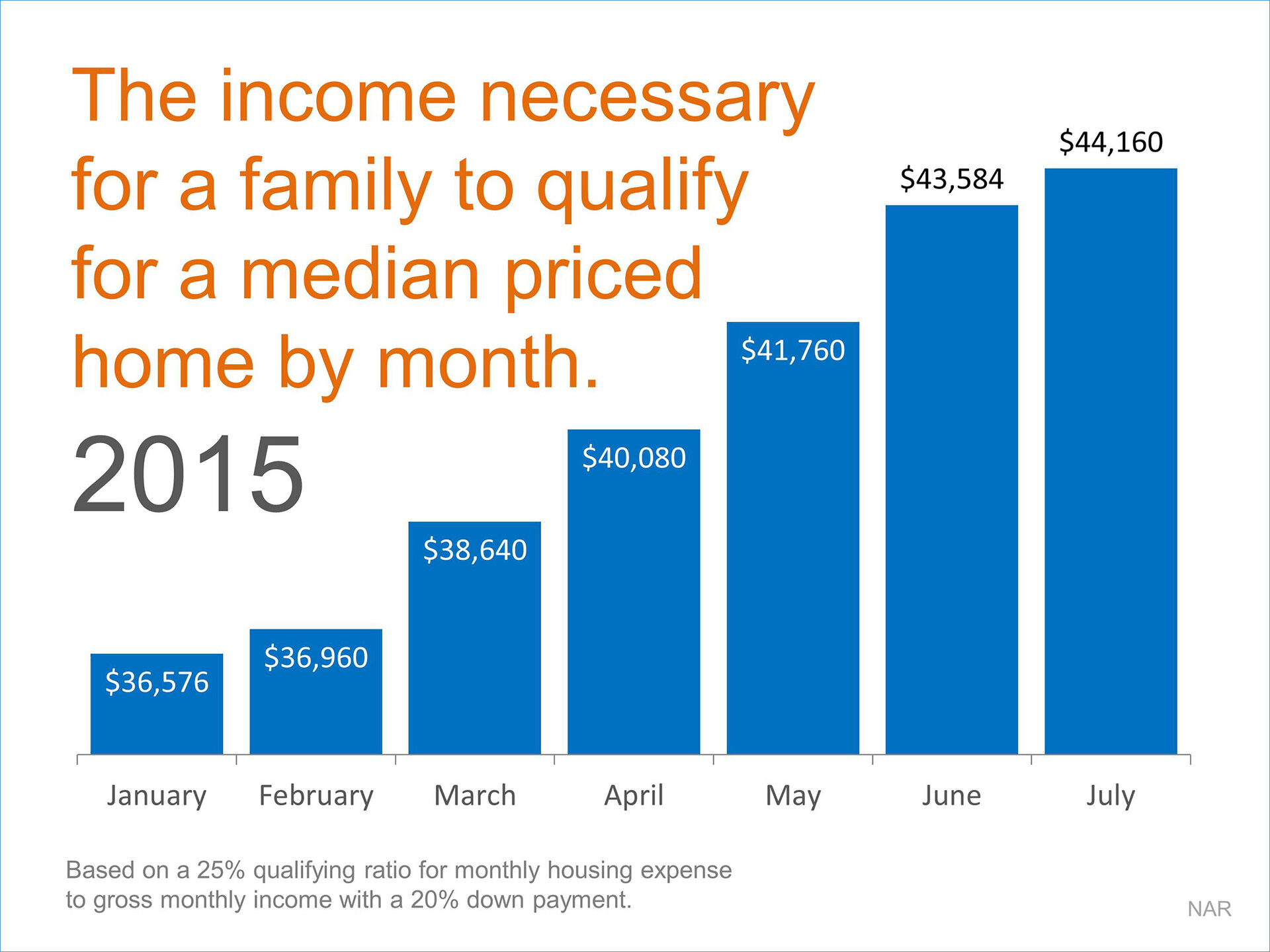

And the income requirement has accelerated even more dramatically this year as prices have risen:

Bottom Line

Some buyers may be waiting to save up a larger down payment. Others may be waiting for a promotion and more money. Just realize that, while you are waiting, the requirements are also changing.

No comments:

Post a Comment